Are you interested to activate an ICICI PayLater account? If you are an ICICI Bank customer then you can also apply for PayLater account and get up to 20,000 INR credit limit. You can use this amount for online payments like online shopping, billing, and payments. And of course, you can also transfer your Pay later money to other bank accounts through UPI.

You can pay your due amount directly through your savings account (It will be auto-debited from your saving account) within 45 days and yes no interest rate will be applied.

{1} You can activate a PayLater account thru a mobile banking application and manage your account. To activate ICICI PayLater, just login to ICICI mobile banking and tap on “Accounts & Deposits”

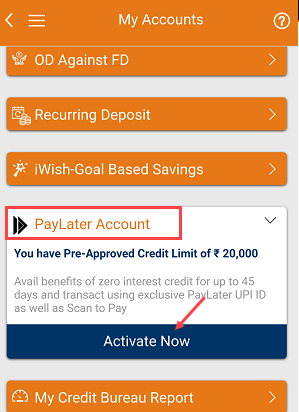

{2} Next screen click on the “PayLater Account” option. You can see here (You have a pre-approved credit limit of 20,000) that means you are eligible for a Pay later account. Tap on Activate Now button and proceed.

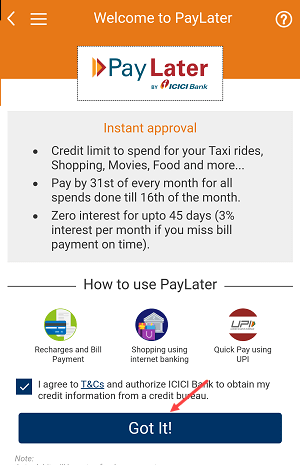

{3} Next screen read the terms and conditions and accept them & proceed further.

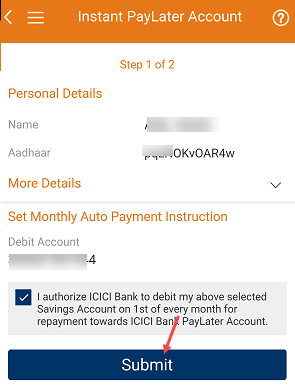

{4} Next screen you need to set monthly auto payment instructions and select your saving account number for auto debit. Now the due amount will be debited from your saving account automatically and you don’t have to pay your dues manually.

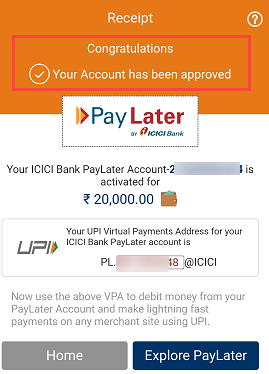

{5} All done, your ICICI PayLater account is activated now. Now you can use your credit limit amount for online usage. You can see your UPI ID for Pay later account. Use this UPI ID (VPA) to make payment using BHIM UPI.

You can also withdraw your ICICI Pay later money, just link your ICICI Pay later account with any UPI application, transfer money to another bank account and then withdraw from the ATM machine. Same way, you can transfer your Pay later money to any bank account by linking your Pay later account with any UPI application.