How To Send Money with IMPS on Axis Mobile Banking

With Axis Mobile Banking IMPS Money Transfer, you can send up to 5 lakh to any bank account instantly

Today we will guide you on how to do an IMPS money transfer using Axis Mobile Banking.

If you don’t know, let me explain that IMPS (Immediate Payment Service) is a money transfer facility like UPI that allows you to send money instantly to any bank account using the account number and IFSC code.

On Axis Mobile Banking you can transfer up to INR 5 lakh per transaction to any bank account instantly with IMPS money transfer same as UPI.

Suppose you are unable to use UPI for Axis Bank transactions, you can use IMPS for urgent money transfers through Axis Mobile banking. Read also: How to change Axis mobile number online without visiting the branch

Axis Mobile Banking IMPS Money Transfer (Step by Step)

If you are transferring money for the first time to any bank account then first you need to add a payee bank account and then you can initiate any transaction. If the payee bank account is already added then you can skip this step.

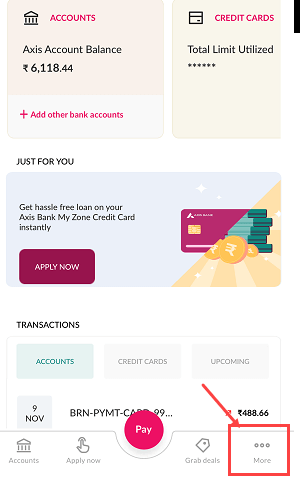

(Step 1) The first step is to add the beneficiary bank account as a payee. For this open Axis Mobile Banking and go to the “More” section.

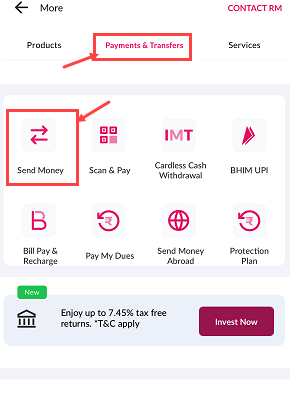

(Step 2) Now select the “Payment & Transfers” option and click on the “Send Money”

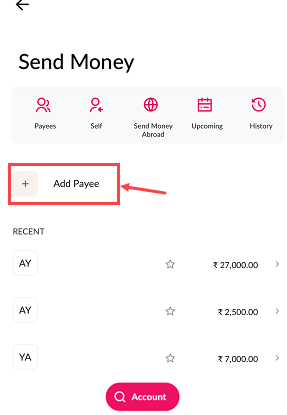

(Step 3) Next screen, tap on the +Add Payee option to add a beneficiary account as a payee.

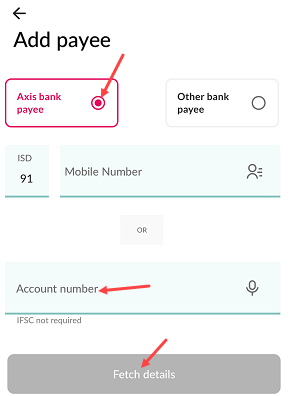

(Step 4) For Axis Bank account users, select the “Axis Bank Payee” option and enter his/her account number and click on the fetch details. Once you click on the fetch details, beneficiary bank account details will be fetched and you can add as a payee.

(Step 5) For other bank account holders, select the “Other Bank Payee” option and enter name, account number and IFSC code and click on the Add Payee.

Done! We have added the payee’s bank account and we can transfer money to his/her bank account through IMPS, NEFT and RTGS.

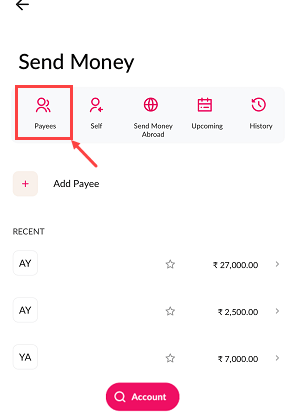

(Step 6) For money transfers, go to send money and tap on the “Payees” option to view the added payee.

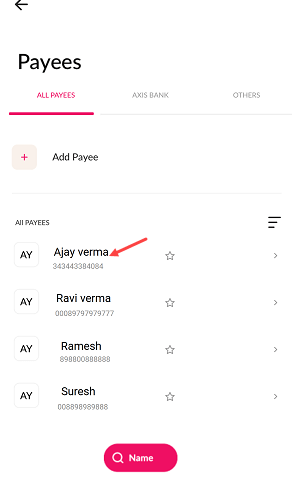

(Step 7) You can view all your payees here. Select the payee to transfer money to his/her bank account through IMPS.

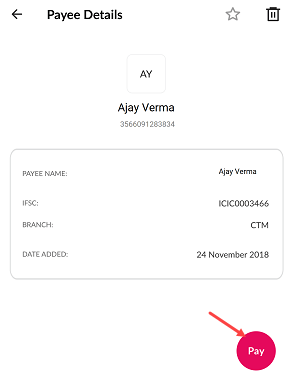

(Step 8) Next screen tap on the “Pay” option to proceed money transfer.

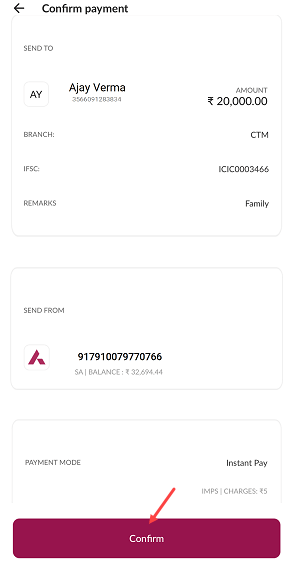

(Step 9) Next screen enter the amount (maximum limit is 5 lakh), select “Instant Pay IMPS” in payment mode, select your debit bank account and click the proceed button.

(Step 10) Next screen check your transaction details, if all is fine then tap on the confirm button.

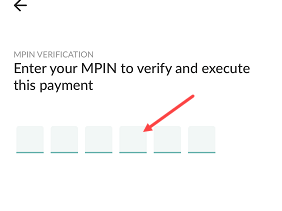

(Step 11) Next screen submit your MPIN to confirm your transaction.

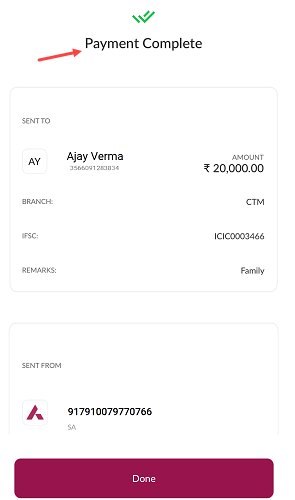

Your Transaction is successful. The amount will be credited to the payee’s bank account instantly.

Please note, that you will be charged Rs.5 transaction fee for the IMPS money transfer on Axis mobile banking.

So Axis Bank customers if UPI is not working or you need to transfer an amount greater than 1 lakh instantly to any bank account, then you can use the IMPS money transfer facility. Although a nominal fee of Rs.5 will be charged, you can send a large amount instantly to any bank account with IMPS facility, using Axis Mobile Banking. Read also: How to check Axis bank debit card details online