Axis bank account holders can now approve their IPO mandate directly on mobile banking, without relying on third-party applications. This feature has been launched recently by the bank on mobile banking so if you are an Axis Bank customer then this guide will help you to check and approve the IPO mandate on the mobile banking app.

If you are still confused and unsure about a step, refer to this step-by-step tutorial to learn how to find and approve an IPO mandate request on Axis Mobile Banking. Read this: How to Approve IPO Mandate on Axis BHIM Pay UPI App

How To Approve IPO Mandate on Axis Mobile Banking App

Before you start applying for an IPO, you need to create your UPI account on the Axis Mobile App. Next, create your UPI ID with the desired @axisbank handle name. Once your UPI account is created and your bank account is linked to your UPI ID, you can place your IPO order and create a UPI mandate request.

If you have already created your UPI account on the Axis Mobile App, then let’s place an IPO order and create a UPI mandate request by login to the Demat account app.

1. Place IPO order and Send UPI Mandate request to Axis Mobile Banking for approval

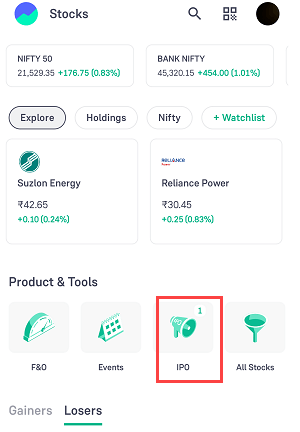

(Step 1) Login to your Demat account App and open the “IPO” Dashboard where you can see the active IPO list.

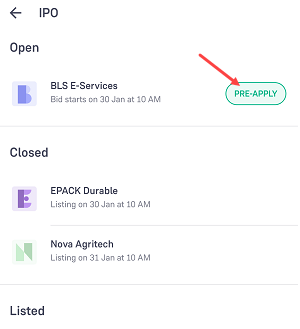

(Step 2) Select your IPO which you want to apply and tap on the Apply Button.

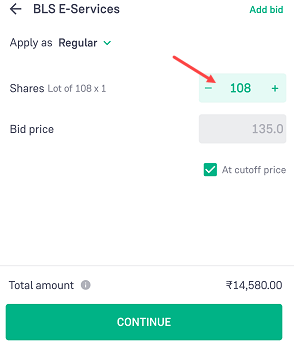

(Step 3) Enter the lot numbers you want to apply and proceed.

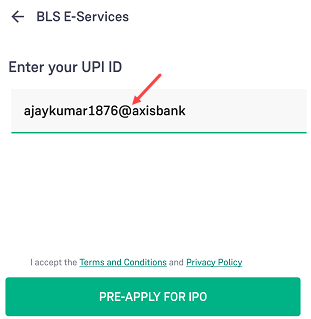

(Step 4) To apply for IPO, you need to enter your Axis Bank UPI ID which can be found on your mobile banking app. Simply log in to your mobile banking app to check your UPI ID, then enter it here.

(Step 5) You have successfully applied for an IPO and your UPI mandate request has been sent to Axis Mobile Banking. Once you approve the mandate request, your IPO application will be finished.

2. Accept IPO Mandate Request on Axis Mobile Banking

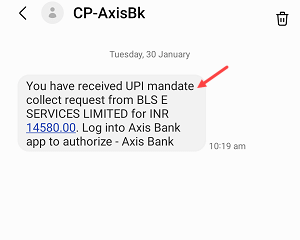

After creating an IPO mandate request from your Demat account, it may take up to 30 minutes for the request to appear on Axis Mobile banking. When you receive a mandate request on the mobile banking app, you will be notified by an SMS sent from Axis Bank.

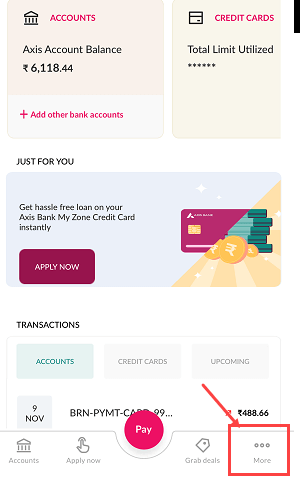

(Step 1) Simply log in to the Axis Mobile Banking App and tap on “More” located in the bottom right corner, as shown in the screenshot below.

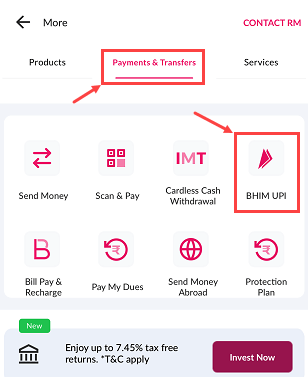

(step 2) Tap on “Payment & Transfers” and then open the “BHIM UPI” section.

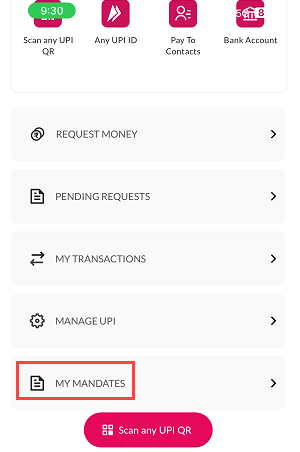

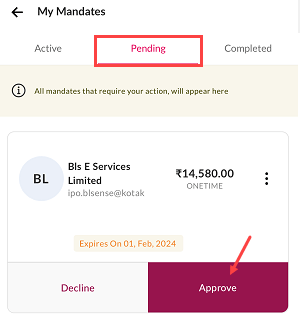

(Step 3) When you open the BHIM UPI dashboard, you will find the “My Mandates” option, click to open.

(Step 4) In the My Mandates screen, navigate to the “Pending” section where you will find your IPO mandate request. Click on the “Approve” button to accept the request.

After your approval, the IPO amount will be blocked in your Axis Bank account, and the IPO application will be submitted successfully. You can check the status of your IPO application by going back to your Demat account’s IPO section. Read also: How to update Axis Bank registered mobile number online

What Next?

There is no need to take any action now. Simply wait for the IPO allotment date. You will either receive an email notification or you can check the status by logging into your Demat account.

Once you are allotted the IPO shares, the blocked amount will be debited from your Axis bank account. On the day of listing, the allotted shares will be credited to your Demat account. In case you are not successful in getting the IPO allotment, the blocked amount will be unblocked and credited to your account within 7 days.

Axis Mobile Banking now offers an easy way to view and approve your IPO mandate request. Simply create a UPI account and use this feature today.