NEFT (National Electronic Funds Transfer) is a simple and secure way to transfer funds between bank accounts in India. Offered by HDFC Bank, it allows you to transfer money conveniently using your mobile banking app. This guide provides a detailed process to perform an NEFT transfer, the time it takes, and common questions users have about the service.

Before initiating an NEFT transfer, ensure that the payee’s bank account has been added to your HDFC Mobile Banking account. After adding the payee, you must wait 4 hours before transferring money.

What is NEFT?

NEFT is a system managed by the Reserve Bank of India (RBI) that facilitates electronic fund transfers. Unlike instant payment systems like IMPS, NEFT processes transactions in batches but remains a reliable and widely used method for transferring funds securely.

- Transfer Limits: There is no lower limit for an NEFT transaction. The upper limit depends on your HDFC account type and the daily transaction limit.

- Processing Time: Funds are usually credited to the recipient’s account within 1 hour during banking hours. Transfers initiated after working hours are processed in the next available cycle.

How to Transfer Money Using NEFT on HDFC Mobile Banking App

Once you’ve added the payee, follow these steps to transfer money via NEFT:

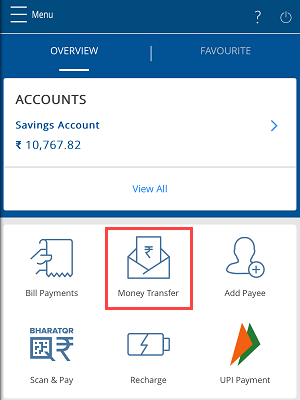

Step 1: Open the HDFC Mobile Banking app and navigate to the Money Transfer section.

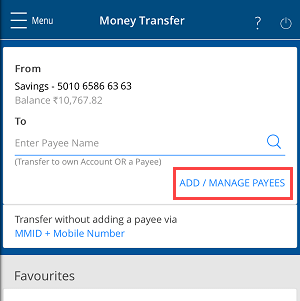

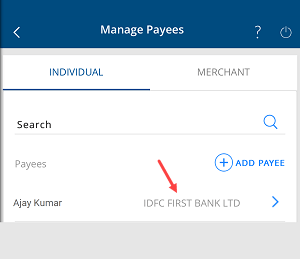

Step 2: Tap on Add/Manage Payee to view the list of payees. Ensure the payee has been activated (4-hour waiting period post-addition).

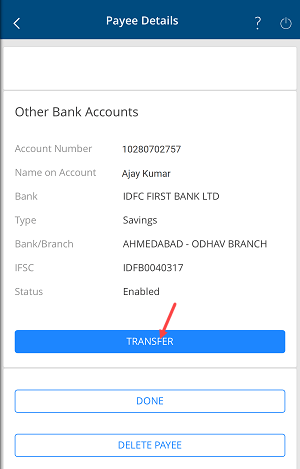

Step 3: Select the payee to whom you wish to transfer money and click Proceed.

Step 4: Choose the Transfer option.

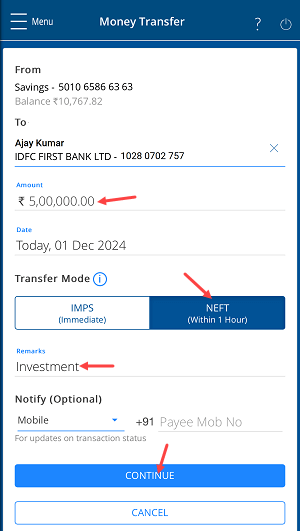

Step 5: Enter the amount you want to transfer and select NEFT as the transfer method. Add a reason for the transaction in the remarks field and click Continue.

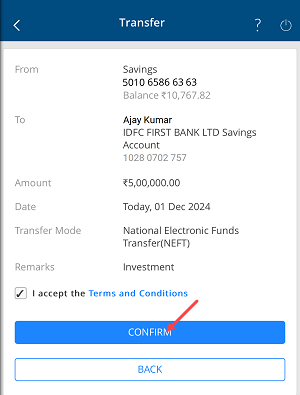

Step 6: Review the details of your transfer, including the payee name, account number, and transfer amount. Once verified, press Confirm.

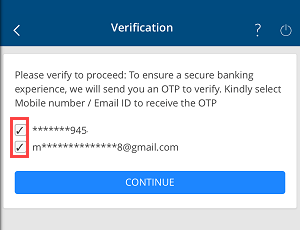

Step 7: Select your mobile number and email ID to receive a One-Time Password (OTP).

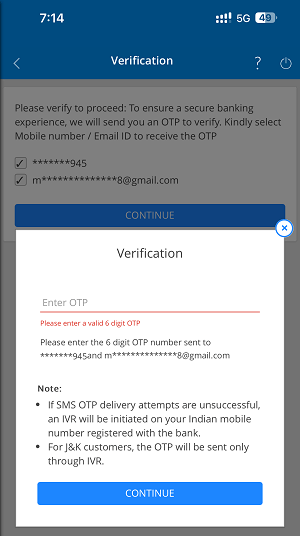

Step 8: Enter the OTP received on your registered mobile number and email ID, then click Validate to authenticate the transfer.

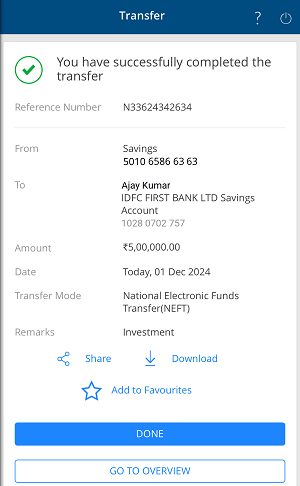

Step 9: Congratulations! Your NEFT transfer is now complete. The amount will be deducted from your account and credited to the recipient’s account within 1 hour.

You can download the transaction receipt from the app and share it with the payee as confirmation.

How to Check the Status of an NEFT Transfer

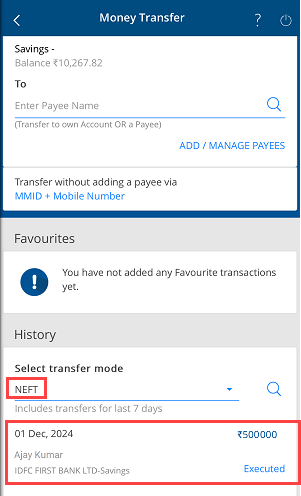

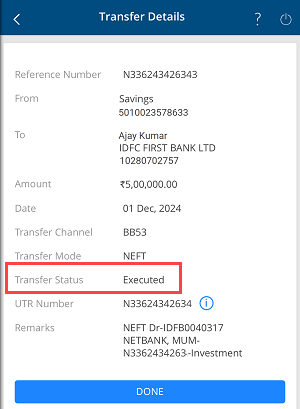

If you want to verify whether your NEFT transaction has been successfully processed:

- Open the Money Transfer section in the HDFC Mobile Banking app.

- Navigate to History and select the NEFT option.

- Find your transaction in the list and tap on it for details.

- If the status displays Executed, the funds have been successfully credited to the payee’s account.

FAQs About NEFT Transfers in HDFC Mobile Banking

Q: Is there any charge for NEFT transactions via HDFC Mobile Banking?

A: HDFC Bank typically charges nominal fees for NEFT transactions based on the amount. However, some accounts (e.g., premium accounts) may offer free NEFT services.

Q: Can I cancel an NEFT transaction after confirming it?

A: Once an NEFT transaction is initiated, it cannot be canceled. Ensure all details are accurate before confirming.

Q: What should I do if my NEFT transfer fails?

A: If your NEFT transfer fails, the amount will be refunded to your bank account within a few working hours. Contact HDFC Bank customer service if the issue persists.

Q: Is NEFT available 24×7?

A: Yes, NEFT operates 24×7, including weekends and holidays. Transactions outside banking hours will be processed in the next available batch.

Q: Can I use NEFT for international transfers?

A: No, NEFT is only available for domestic transactions within India. For international transfers, you can use other HDFC services like SWIFT.

Conclusion

Using HDFC Mobile Banking for NEFT transfers is convenient, secure, and efficient. By following the steps outlined above, you can easily transfer funds to any bank account in India. Always double-check the payee details and transaction amount to avoid errors. With its round-the-clock availability and robust processing, NEFT remains one of the best ways to transfer money electronically.