Transferring money has never been easier, thanks to the advent of Unified Payments Interface (UPI). As a Bank of India (BOI) customer, you can use the Omni Neo mobile banking app to make quick and secure transactions. This guide provides detailed instructions for using UPI to transfer money effortlessly.

Whether you’re sending funds via a UPI ID, mobile number, or even using a bank account number and IFSC code, we’ve got you covered with step-by-step instructions. Let’s explore how you can maximize the convenience of UPI with BOI’s mobile banking services.

What You Need to Get Started

To ensure a seamless experience, make sure:

- You are registered for BOI Mobile Banking on the Omni Neo app.

- Your UPI services are activated, and your BOI bank account is linked.

How to Transfer Money Using UPI on BOI Mobile Banking

With the Omni Neo mobile banking app, transferring money via UPI is a straightforward process. BOI offers an intuitive interface that ensures your transactions are quick and secure. Follow the steps below to transfer money using UPI:

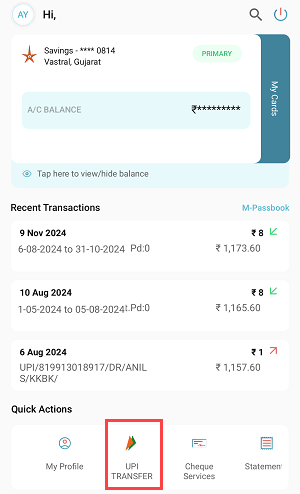

Step 1: Login to the BOI Mobile Banking App

- Open the Omni Neo app and log in with your credentials.

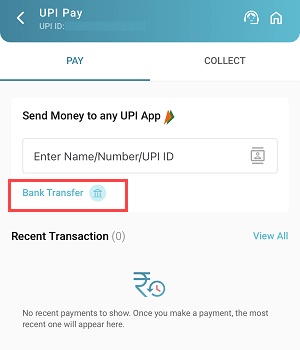

- On the home screen, select the “UPI Transfer” option.

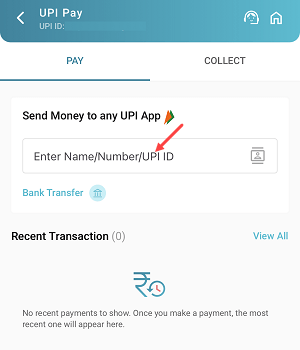

Step 2: Enter Recipient’s UPI ID or Mobile Number

- Input the UPI ID or mobile number of the recipient.

- If the mobile number doesn’t work, it’s best to use the UPI ID for accuracy.

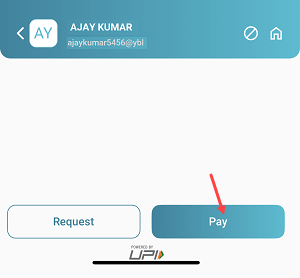

Step 3: Verify and Proceed

- The system will verify the recipient details.

- After verification, tap “Pay” to continue.

Step 4: Specify Transfer Amount

- Enter the amount you wish to transfer. Remember, the daily limit is ₹1,00,000.

- Tap “Pay Now” to proceed.

Step 5: Authenticate with Your UPI PIN

- Enter your UPI PIN to authorize the transaction.

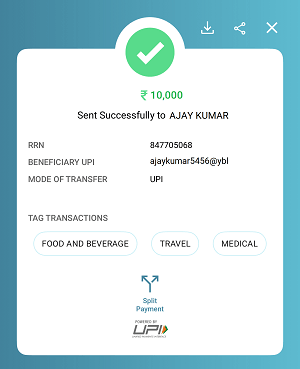

Step 6: Success Confirmation

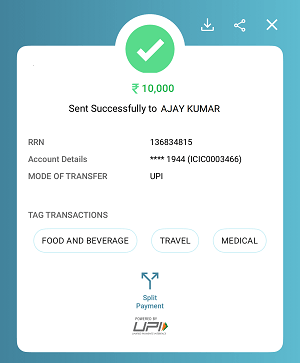

- The transfer will be completed instantly, and the funds will be credited to the recipient’s account.

Transferring Money Using Account Number and IFSC Code

If the recipient does not have a UPI ID, you can still use UPI to transfer funds via their bank account number and IFSC code. Follow these steps:

Step 1: Select Bank Transfer Option

- On the home screen, choose “UPI Transfer” and then select “Bank Transfer”.

Step 2: Enter Beneficiary Details

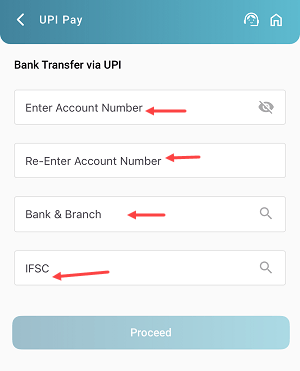

- Provide the recipient’s:

- Bank account number.

- Bank name (choose from the list).

- IFSC code.

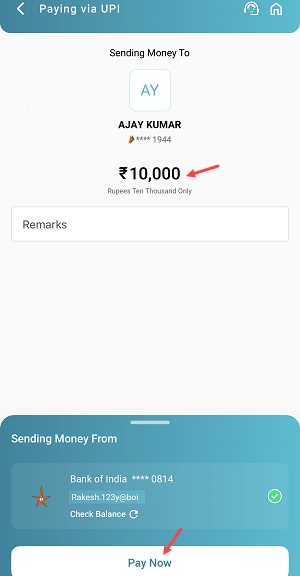

Step 3: Enter Transfer Amount

- Specify the amount to be transferred.

- Tap “Pay Now” to proceed.

Step 4: Authenticate with UPI PIN

- Input your UPI PIN to confirm the transaction.

Step 5: Instant Transfer Confirmation

- The money will be credited to the recipient’s account instantly.

Key Benefits of UPI Money Transfer

- Instant Transfers: Transactions are completed in real-time, 24/7.

- Multiple Options: Transfer using UPI ID, mobile number, or bank account details.

- High Daily Limit: Transfer up to ₹1,00,000 per day.

- Secure Transactions: UPI PIN ensures every transaction is authenticated.

Pro Tips for Smooth Transactions

- Always double-check the recipient’s details (UPI ID, mobile number, or bank account).

- Ensure your mobile number is registered with BOI and linked to your account.

- Keep your UPI PIN confidential and never share it with anyone.

With these simple steps, you can make the most of UPI services on Bank of India’s Omni Neo app. Start transferring money seamlessly and securely today!