Approving an IPO mandate is a crucial step in applying for Initial Public Offerings (IPOs). With Kotak Mobile Banking Lite, the process is smooth and hassle-free. If you are an investor looking to secure an IPO allocation, understanding how to approve mandates using this app is essential.

This guide will walk you through the complete process—from placing an IPO order via your Demat account to approving the mandate on the Kotak Mobile Banking Lite app. By following these steps, you can ensure a successful IPO application while keeping your investments secure.

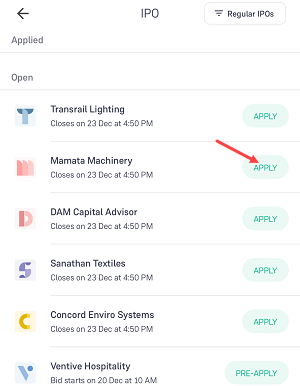

Step 1: Place an IPO Order Using Your Demat Account

1. Log in to Your Demat Account

- Open your preferred Demat account platform (e.g., Groww, Zerodha, or any other broker).

- Navigate to the IPO section to explore active IPOs.

- Select the IPO you wish to apply for and tap on the Apply button.

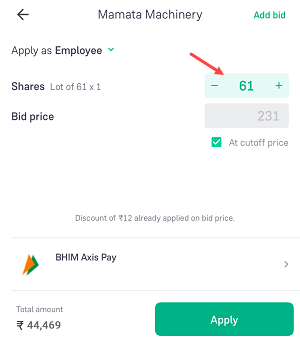

2. Enter IPO Application Details

- Specify the number of lots you want to apply for.

- Choose the Edit Payment Option to provide your UPI ID.

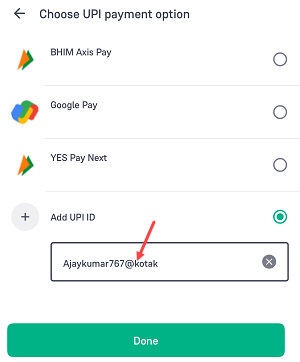

3. Add Kotak Mobile Banking Lite UPI ID

- If you’re unsure of your UPI ID, open the Kotak Mobile Banking Lite app to check it.

- Enter the UPI ID and confirm by tapping the Done button.

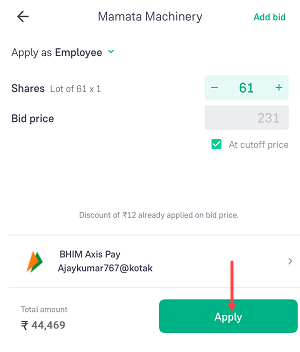

4. Submit Your IPO Application

- After entering the required details, click on the Apply button to complete the application process.

- A mandate request will be created and sent to Kotak Mobile Banking Lite for approval.

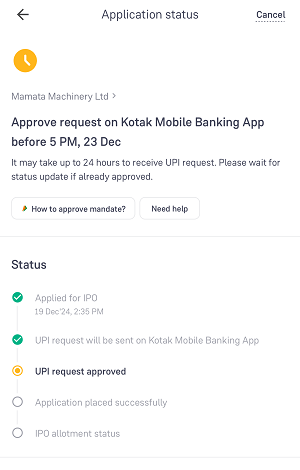

5. Wait for the Mandate Request to Arrive

- It may take up to 4 hours for the IPO mandate request to appear in your Kotak Mobile Banking Lite app.

- You’ll receive an SMS notification once the mandate is ready for action.

Step 2: Approve the IPO Mandate on Kotak Mobile Banking Lite

Once the mandate request is received, follow these steps to approve it:

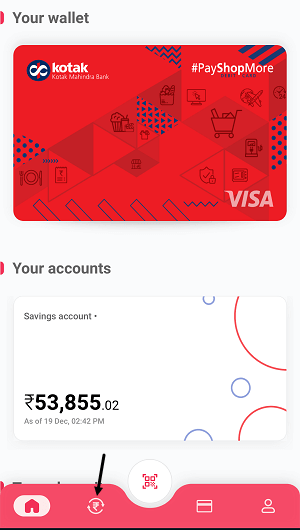

1. Open Kotak Mobile Banking Lite App

- Log in to the app using your credentials.

- Tap the Rupee icon at the bottom of the screen to access the payment section.

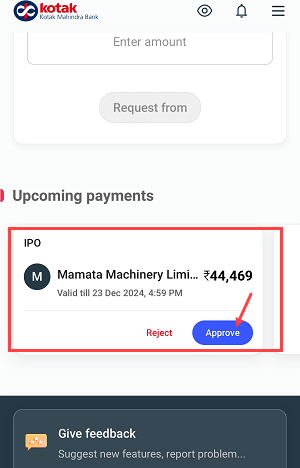

2. Locate the Mandate Request

- Scroll through the screen to find pending mandates.

- Tap on the IPO mandate request to proceed.

- Tap on the Approve button to continue.

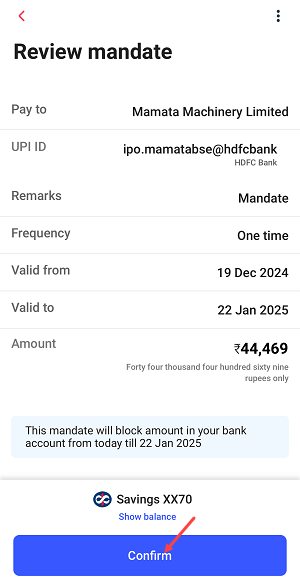

3. Confirm the Approval

- Click on the Confirm button to finalize the approval.

- Submit your response.

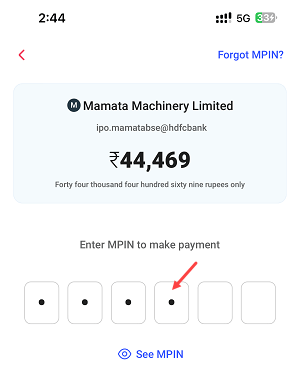

5. Authenticate Using Your MPIN

- Enter your MPIN for secure authentication.

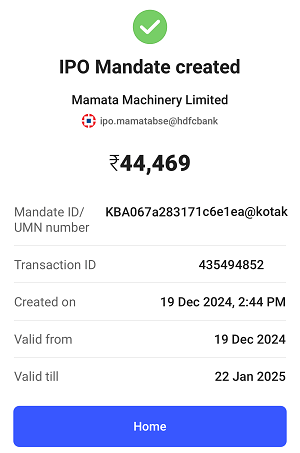

6. Completion Confirmation

- Once the process is complete, the required amount will be blocked in your account. Remember, this amount will not be debited but will temporarily reduce your available balance.

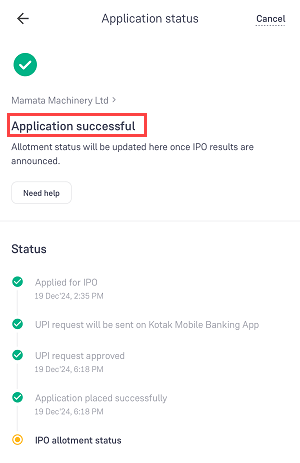

Step 3: Verify Application Status

After successfully approving the mandate, verify your application status in your Demat account:

- Log in to your Demat account.

- Navigate to the Applied IPOs section.

- Check the status after a few hours to ensure the mandate has been approved.

If the IPO allotment is successful, the blocked amount will be debited from your account. Otherwise, the amount will be released back to your account balance.

Key Takeaways

Approving IPO mandates through the Kotak Mobile Banking Lite App is a secure and efficient way to complete your IPO application process. By carefully following the steps outlined above, you can ensure your application is error-free and promptly submitted.

There are many third-party apps available for IPO mandates approval, however you can use Kotak Lite mobile banking if you are holding a Kotak Bank account and don’t want to use other application.