Managing your finances has never been easier, thanks to the ICICI Bank iMobilePay app, which brings banking directly to your fingertips. With iMobilePay, ICICI customers can seamlessly transfer funds, pay bills, check balances, and manage accounts—all from their smartphone. This step-by-step guide will help you activate iMobilePay, enabling you to enjoy the benefits of mobile banking anytime, anywhere.

Getting started with ICICI’s mobile banking is simple and secure. The activation process involves verifying your registered mobile number, setting a secure PIN, and choosing an activation method that suits you, whether via your ICICI debit card or Net Banking credentials. Follow along as we guide you through each step to make the activation process quick and easy.

How to Activate ICICI Bank Mobile Banking (iMobilePay): A Detailed Step-by-Step Guide

Activating ICICI Bank’s mobile banking service, iMobilePay, empowers you to manage your finances conveniently on your smartphone. Here’s a comprehensive guide to help you through the activation process.

Prerequisite

Before you begin, make sure that:

- Your ICICI-registered mobile number is inserted in your device, as the app will send a verification SMS to confirm your identity.

Step 1: Download and Install iMobilePay

- Go to the Google Play Store (for Android users) or the App Store (for iOS users).

- In the search bar, type “iMobilePay by ICICI Bank” and select the app from the list.

- Tap on Install and wait for the app to download and install on your device.

- Once installed, open the iMobilePay app.

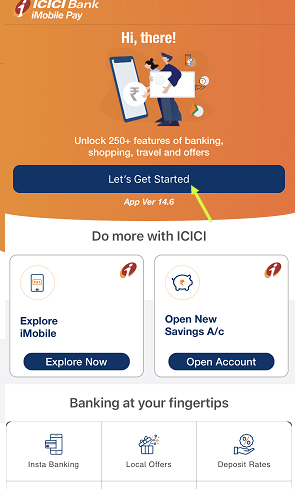

Step 2: Start the Activation Process

- When you first open the app, you’ll see a “Let’s Get Started” button. Tap on it to begin.

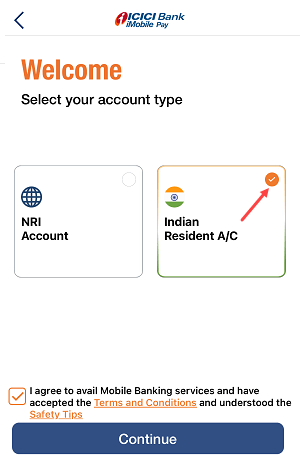

- The app will prompt you to choose an account type. Select “Indian Resident A/c” if you are activating an account for an Indian resident.

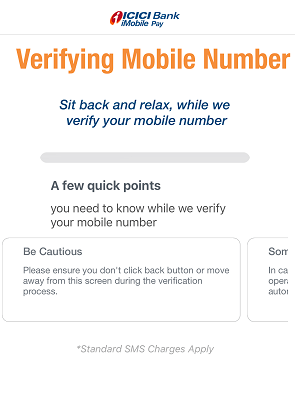

Step 3: Verify Your Mobile Number

- The app will request permission to access your phone’s SMS feature to verify your registered mobile number.

- Allow the app to send an SMS from your device. This SMS is automatically generated to authenticate your registered mobile number with ICICI Bank.

- After a few moments, the app will confirm if your mobile number has been successfully verified.

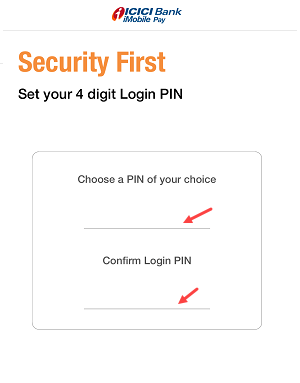

Step 4: Set Up a 4-Digit Login PIN

- You’ll be prompted to create a 4-digit PIN to secure your mobile banking app. Choose a unique PIN that you can remember easily.

- Enter the PIN, and then re-enter it if prompted to confirm.

- This PIN will serve as your login credential, allowing you to access the iMobilePay app securely.

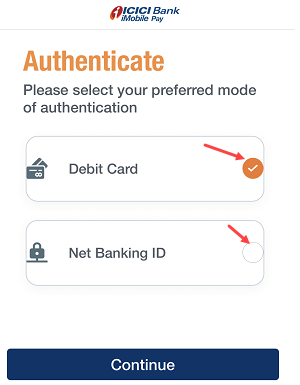

Step 5: Choose an Activation Method

ICICI Bank offers two activation options for mobile banking access:

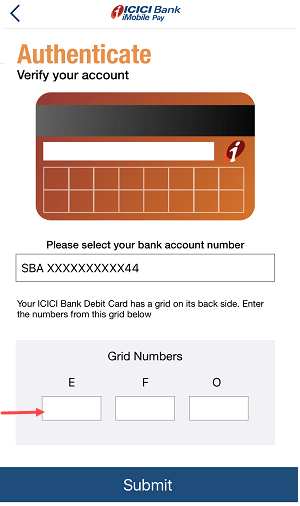

Option 1: Activate Using Debit Card

- Select the Debit Card option.

- Locate your ICICI Debit Card and look for the grid of numbers on the back side. These are essential for verifying your identity.

- Enter the grid values as requested by the app.

- Double-check that you’ve entered the correct numbers and then tap Submit to complete the activation.

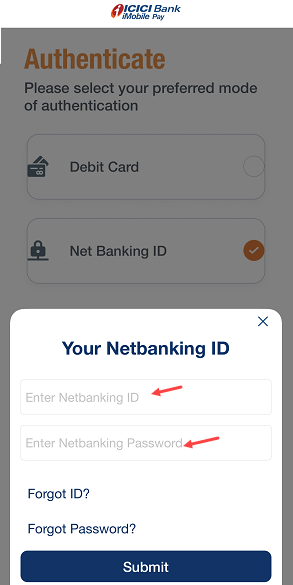

Option 2: Activate Using Net Banking

- Alternatively, select the Net Banking option.

- Enter your User ID and Login Password associated with your ICICI Bank’s Net Banking account.

- Submit the login credentials, and the app will verify them to complete the activation process.

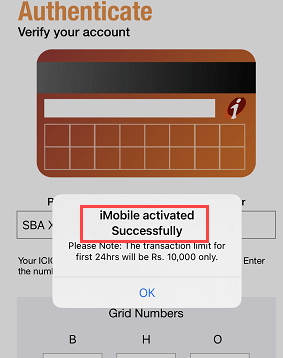

Step 6: Confirmation of Activation

- Once your details are verified, you will receive a confirmation message notifying you that your iMobilePay account setup is complete.

- Congratulations! You can now access your ICICI mobile banking account and start using iMobilePay to manage your finances.

Features Available in ICICI iMobilePay

With your iMobilePay app activated, you’ll have access to:

- Fund Transfers: Transfer funds to other accounts using, UPI, NEFT, IMPS, and RTGS.

- Bill Payments: Easily pay utility bills and recharges.

- Account Services: Check account balance, view transaction history, and download statements.

- Card Management: Manage debit and credit cards, block lost cards, and more.

FAQs About Activating iMobilePay

Q1: Can I activate iMobilePay without a debit card?

A: Yes, if you don’t have your debit card, you can activate mobile banking using your Net Banking User ID and Password.

Q2: Is iMobilePay safe for transactions?

A: Absolutely. iMobilePay uses multiple security layers, including PIN protection, mobile number verification, and data encryption to secure your transactions.

Q3: What if I change my mobile number?

A: If you change your mobile number, contact ICICI’s customer support to update it in their records for continued access to mobile banking.

Q4: Can I reset my 4-digit login PIN?

A: Yes, if you forget or want to change your PIN, you can reset it within the app by verifying your identity with your registered mobile number and other credentials.