Numerous UPI applications can be found on both the Google Play Store and Apple Store, offering convenient access to UPI services. However, HDFC Bank customers possess a distinct advantage – they can conduct UPI transactions without relying on third-party apps.

With HDFC mobile banking, HDFC Bank customers can easily create their UPI account and UPI IDs directly on their mobile phones. This is great because you don’t have to create a UPI PIN when you set up your UPI account, which you have to do with other UPI apps. So, it’s simpler and faster to start using UPI for transactions through HDFC mobile banking.

Here is a comprehensive guide on how to create an official HDFC UPI account and UPI ID using the HDFC mobile banking app:

Step-by-Step Guide to Creating a UPI Account on HDFC Mobile Banking

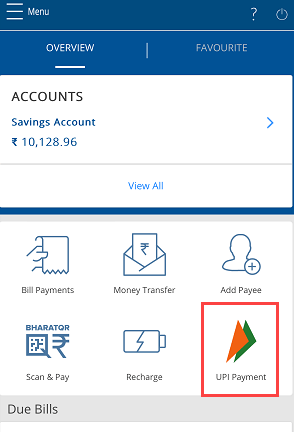

Step 1: Commence by launching the HDFC mobile banking application and logging into your account. In the app, locate and select the “UPI Payment” section.

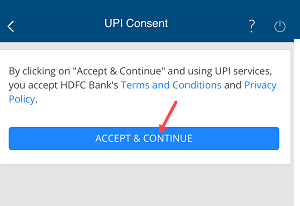

Step 2: After selecting “UPI Payment,” you’ll be prompted to review and accept the terms and conditions associated with UPI services. Once accepted, tap the “Continue” button to proceed.

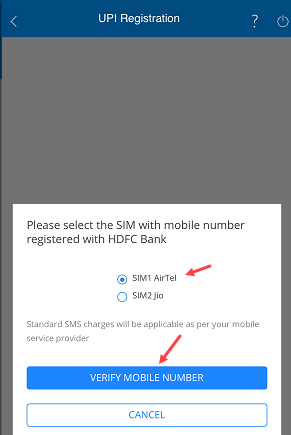

Step 3: To validate your identity and association with HDFC Bank, the app will send an automatic SMS to your registered mobile number. Select the SIM card linked to your registered mobile number and tap “Verify mobile number.” Ensure your mobile phone has enough balance to send the SMS for verification.

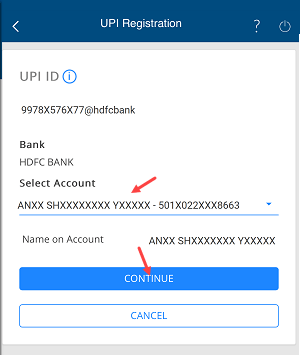

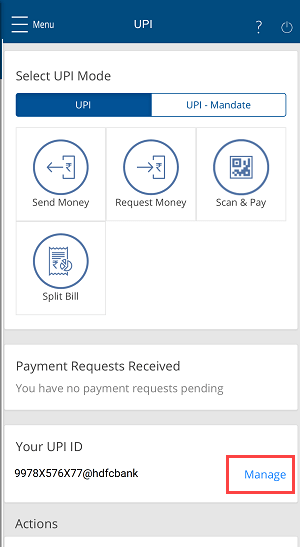

Step 4: Following the successful validation of your registered mobile number, the app will generate your unique UPI ID, which will typically include “@hdfcbank.” On the next screen, you’ll need to choose your HDFC Bank account number and tap “continue” to link this account with your newly created UPI ID.

Step 5: Congratulations! You have now successfully established your UPI account within the HDFC mobile banking app. Your official UPI ID, with “@hdfcbank,” is ready for use. Usually, your UPI ID will be created using your mobile number.

Step 6: With your newly created UPI account, you can conveniently navigate to the “UPI Payment” section within the mobile banking app to access UPI services. You can send money without UPI PIN now.

In essence, HDFC Bank customers can leverage the HDFC mobile banking UPI payment feature to streamline their UPI transactions and craft a unique UPI ID, all without relying on external UPI applications. This empowers them with a seamless and secure method for managing their HDFC accounts using UPI services.