The National Payments Corporation of India (NPCI) has introduced UPI Circle, an innovative feature designed to extend the reach of digital payments to individuals who may not have their own bank accounts. This service allows an existing UPI user (the “primary user”) to authorize trusted individuals (up to five “secondary users”) to make UPI payments from the primary user’s bank account.

This initiative aims to foster financial inclusion, enabling dependents, household staff, or others without bank accounts to conveniently and securely transact using UPI.

What is UPI Circle in PhonePe?

UPI Circle, a feature introduced by the National Payments Corporation of India (NPCI) and available on apps like PhonePe, is designed to expand digital payment access, particularly to individuals who may not have their own bank accounts. It allows an existing UPI user, known as the “primary user,” to authorize up to five “secondary users”—such as family members or trusted individuals—to make UPI payments directly from the primary user’s linked bank account. This initiative aims to bring more people into the digital payment ecosystem by enabling supervised access to UPI facilities.

The primary user invites individuals to their UPI Circle using the secondary user’s UPI ID or QR code (which the secondary user can obtain by registering on a UPI app, even without linking a bank account). The primary user retains full control, with the ability to monitor all transactions and revoke access at any time, ensuring a secure way to manage shared expenses or provide allowances.

Create UPI ID and QR Code Without a Bank Account on PhonePe To Join UPI Circle

Step 1: Install PhonePe App

If you don’t have PhonePe already, download it from the Google Play Store or Apple App Store. Make sure you install the latest version for access to the UPI Circle feature.

Step 2: Register Using Your Mobile Number

Open the app and sign up using your active mobile number. You don’t need a bank account for registration. Complete the initial setup, including basic profile information.

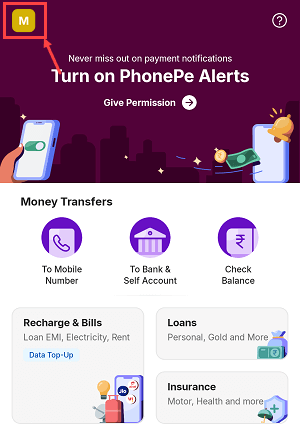

Step 3: Open the Profile Section

Once registration is complete and you’re on the app’s main screen, tap the small profile icon located at the top-left corner of the screen. This opens your personal settings.

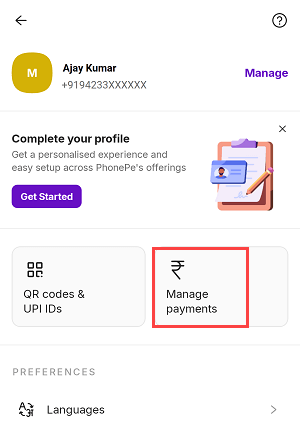

Step 4: Navigate to Manage Payments

Scroll through your profile options and select “Manage Payments.” This section handles everything related to UPI, including bank accounts and the UPI Circle feature.

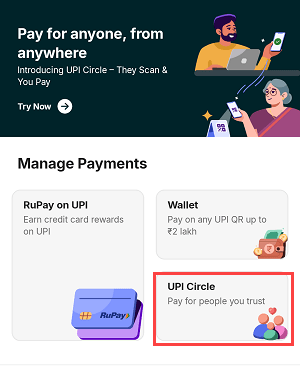

Step 5: Select UPI Circle

In the Manage Payments section, look for an option called “UPI Circle.” Tap on it to begin the setup.

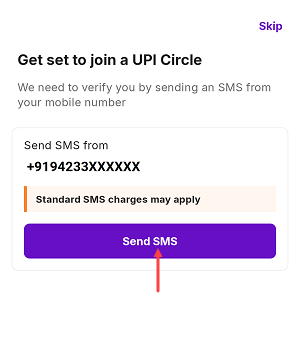

Step 6: Verify Your Mobile Number via SMS

The app will ask you to verify your number by sending an SMS from your phone. Tap on the “Send SMS” button. Ensure that your SIM card has enough balance to send a message.

The SMS will be auto-generated and sent to PhonePe’s server to verify the mobile number. Once successfully verified, you will proceed to the final step.

Step 7: UPI ID and QR Code Are Generated

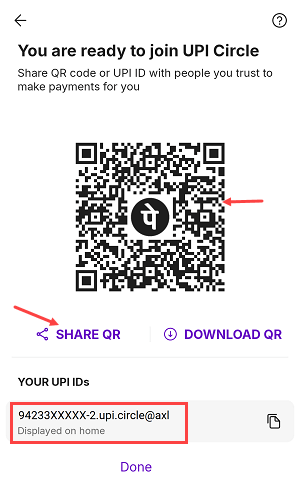

After SMS verification, your unique UPI ID and QR code will be generated by PhonePe. These identifiers can now be used by others to send you payments.

How to Use and Share Your UPI Circle ID and QR Code

- You can tap on “Share QR” to distribute your QR code through apps like WhatsApp, Telegram, email, or Bluetooth.

- The UPI ID can also be copied and shared with anyone who wishes to send money to you.

Once you share your UPI ID and QR code, the primary user will add you to the UPI circle using your UPI ID or QR code. After you join the UPI circle, you can make payments using your PhonePe account, with the primary user paying on your behalf.

Example: How UPI Circle Works in Real Life

Imagine Sarah is a working professional (the primary user) and she wants to give her college-going younger brother, Rohan (the secondary user), a way to pay for his daily expenses like lunch and bus fare using UPI. Rohan doesn’t have his own bank account yet.

-

Setup:

- Rohan downloads a UPI app (like PhonePe) on his phone and registers with his mobile number. This gives him a UPI ID & QR code, even without a bank account.

- Sarah, using her UPI app, goes to the “UPI Circle” feature. She invites Rohan to her Circle by entering his UPI ID or scanning his QR code.

- Roahn accepted UPI Circle invitation and Joined Circle

-

Making a Payment:

- Rohan goes to his college canteen and wants to pay a ₹100 bill.

- He opens his UPI app, selects “Scan & Pay,” and scans the canteen’s QR code.

- When prompted for the payment method, he’ll see an option to use Sarah’s account (via the UPI Circle). He selects it and Sent payment request to Sarah.

- Sarah opened the PhonePe app, accepted the request, and paid the amount of 100.

This way, Rohan can conveniently make digital payments, and Sarah has control and visibility over his expenses, all without Rohan needing his own bank account.

Conclusion

In essence, PhonePe’s UPI Circle enables a primary user to authorize payments on behalf of secondary users, even if they don’t have their own bank accounts linked to UPI

In conclusion, PhonePe’s UPI Circle is a significant step towards making digital payments more accessible and manageable for a wider range of users, particularly those in family or trusted networks.