HDFC Bank UPI Money Transfer Without UPI PIN Do you want to enjoy the benefits of the Unified Payments Interface (UPI) system without the hassle of remembering and entering your UPI Personal Identification Number (PIN) every time you want to send money?

If you are an HDFC Bank customer, you can do just that. You can transfer money from your HDFC Bank account to any other bank account via UPI without using the UPI PIN. This is a unique feature that HDFC Bank offers to its customers through its mobile banking application. You don’t need to download any other UPI app, you can use the HDFC mobile banking app itself to send money without UPI PIN.

In this article, we will show you how to set up and use this feature step by step.

HDFC Bank UPI Money Transfer Without UPI PIN

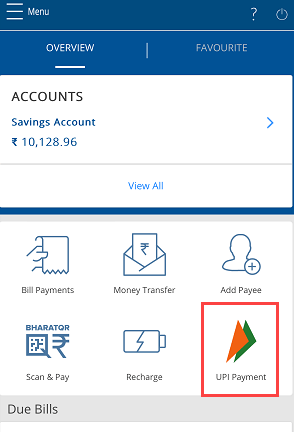

(Step 1) Open your HDFC mobile banking app and select the “UPI Payment” option. This will take you to the UPI section of the app.

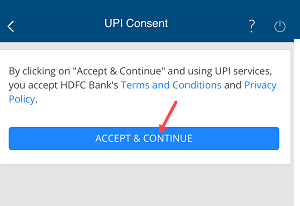

(Step 2) On the next screen, tap on the Accept and Continue button to agree to the terms and conditions and proceed.

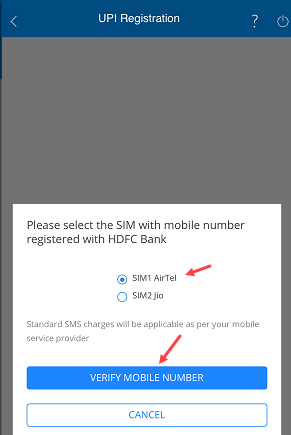

(Step 3) On the next screen, you need to choose the SIM card that has the same mobile number as your HDFC Bank account and confirm your mobile number by SMS. The app will send an SMS to your HDFC-linked mobile number to verify your identity

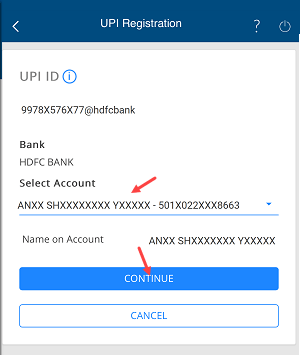

(Step 4) The next screen will display your HDFC Bank account after you verify your registered mobile number. Tap on continue after selecting your account.

(Step 5) Well done! You have created your UPI account successfully. Now no need for a UPI PIN when you send money from your HDFC mobile banking UPI account.

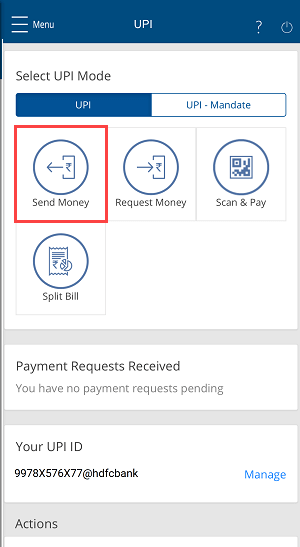

(Step 6) Now you are ready to send money from your HDFC Bank account to any bank account via UPI without UPI PIN. Just tap on the “Send Money” option.

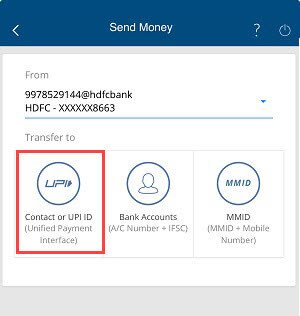

(Step 7) Select the “Contact or UPI ID” option and proceed. You can also select “Bank accounts” option and send money using account number and IFSC code.

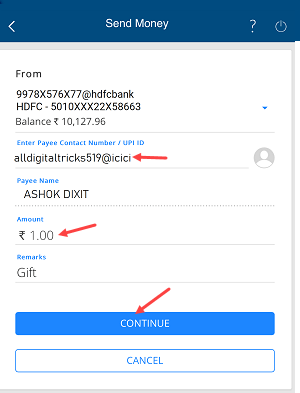

(Step 8) On the next screen, enter the UPI ID or mobile number of the receiver (beneficiary). Enter the amount, type some remarks and tap on continue.

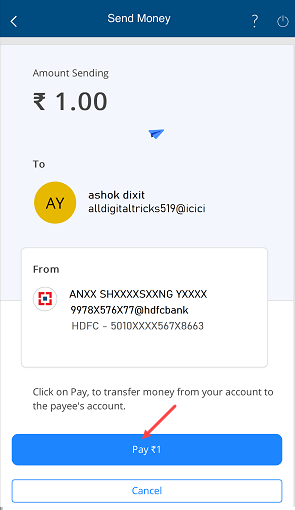

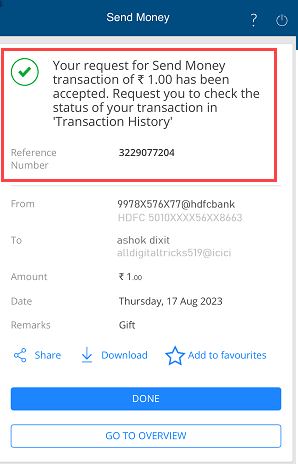

Step 8: On the next screen, confirm your transaction by tapping on the Pay button.

That’s it. You have successfully transferred money to the beneficiary account without using the UPI PIN.

To sum up, sending money without a UPI Personal Identification Number (PIN) directly from an HDFC bank account is a remarkable feature that enhances the convenience and efficiency of digital banking and financial transactions. With this innovative feature integrated into HDFC’s mobile banking platform, customers can experience greater ease and speed in managing their money transfers. So if you want to send money from your HDFC Bank account without UPI PIN then you can use HDFC mobile banking inbuilt UPI service.

Here are some additional details about this feature:

- It is only available to HDFC Bank customers.

- You can send money to any bank account in India that is UPI-enabled.

- There is a daily limit of ₹1 lakh on UPI transactions without UPI PIN.

- This feature is available on both Android and iOS devices.

Overall, HDFC Bank’s UPI money transfer without UPI PIN is a valuable feature that offers customers a convenient and efficient way to send money.