If you are interested in investing a lump-sum amount in a mutual fund scheme on the Groww app, I can guide you through the process. Here we will invest a one-time amount of ₹5000 in Quant small cap direct fund. This fund has a track record of good returns and is suitable for investors with a high-risk appetite. By investing a lump-sum amount, you can take advantage of market fluctuations and potentially earn higher returns compared to starting a Systematic Investment Plan (SIP).

On the Groww app, you can easily select the fund, enter the investment amount, and make the payment through a secure payment gateway. With just a few clicks, you can make a smart investment and start your journey towards wealth creation.

How To invest a lump-sum amount in a mutual fund on Groww

(Step 1) Open the Groww application and head to the “Mutual Fund” section. Here, you can choose from a variety of mutual funds based on your risk appetite. If you’re looking for higher returns with higher risk, you can opt for small-cap and mid-cap funds. On the other hand, if you’re looking for moderate returns with lower risk, you can choose large-cap mutual funds.

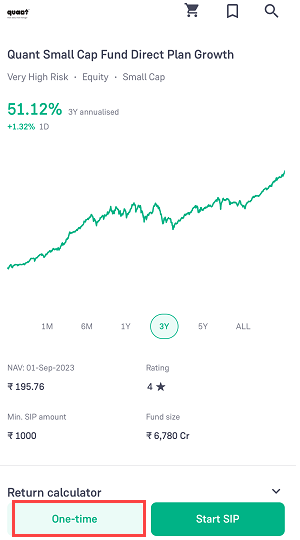

Step 2: Select your preferred mutual fund scheme. For instance, I have chosen the “Quant Small Cap Fund Direct Plan-Growth” and I’m going to invest INR 5000 in this fund.

Step 3: On the next screen, you can view the performance chart and returns of your chosen mutual fund scheme. Since we’re investing a lump-sum amount, select the “One-time” option.

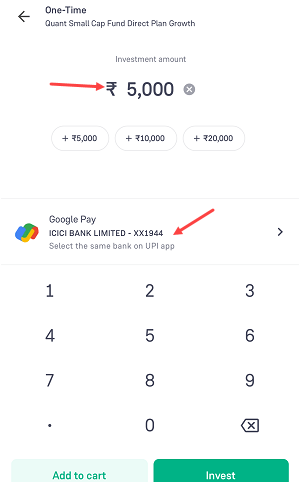

Step 4: Enter the one-time amount you wish to invest. In my case, I have entered INR 5000. Next, select your preferred payment method.

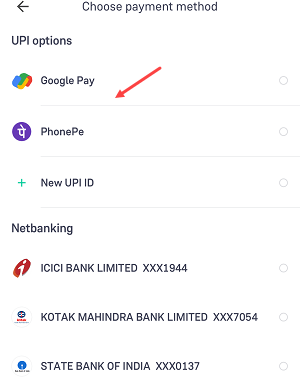

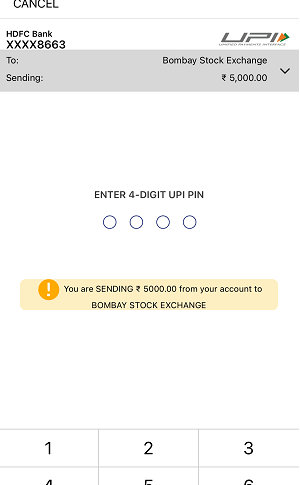

Step 5: You can pay the amount using UPI apps like PhonePe, Google Pay, or any UPI ID. Alternatively, you can also make the payment using net banking. I’m going to select Google Pay.

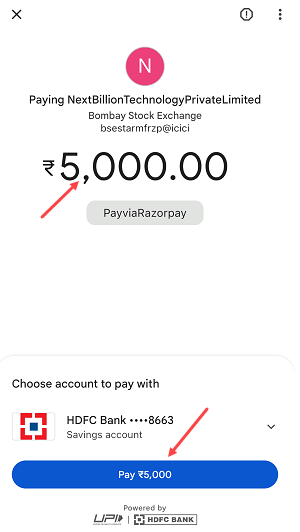

Step 6: On the next screen, pay the amount using the selected UPI application.

Step 7: Enter your UPI PIN and complete the transaction.

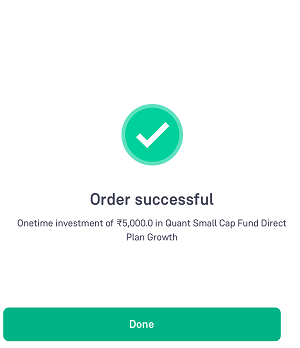

Step 8: Congratulations! You have successfully invested a lump-sum amount in your chosen mutual fund scheme. You can view the “Order successful” screen.

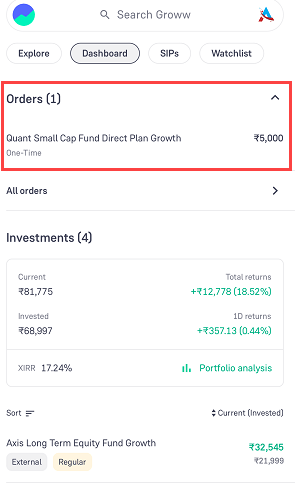

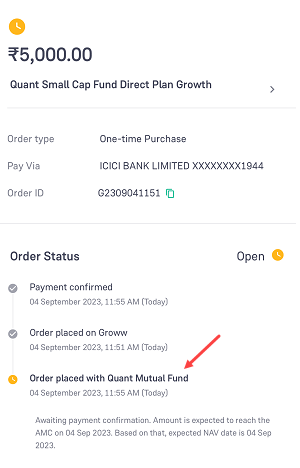

Step 9: Your investment is currently under process and open. You can see your open order in the Mutual Fund section Dashboard. You need to wait for 4-5 working days to complete the order.

Step 10: After 4-5 working days, when the mutual fund (AMC) receives your payment, applicable units will be allotted to your account.

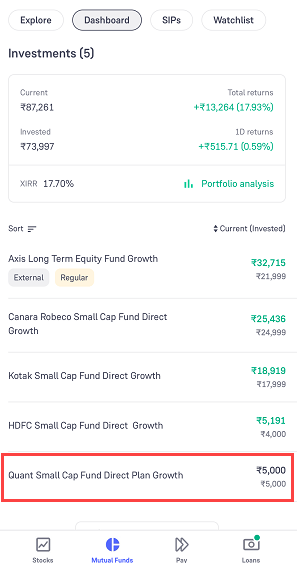

Step 11: Once the unit allocation is successful, you can view your investment in the mutual fund portfolio section, as shown in the screenshot below.

If you want to maximize your returns, it is recommended to hold your mutual fund investment for at least 5 years. However, you can still withdraw a partial amount from your investment whenever you need to. This flexibility allows you to access your funds while still allowing them to grow over time.

If you wish to invest more in the future, simply open your portfolio, select the mutual fund scheme you have invested in, and choose the “One-time” option to pay the amount.

So, there you have it! Investing a lump-sum amount in a mutual fund on Groww is a breeze. If you’re not interested in SIP, you can opt for the one-time option and invest a single amount in any mutual fund scheme of your choice.