If you are using the ICICI iMobile Pay app for UPI transactions, you can now accept IPO mandate requests and apply for IPO applications. No matter if you have an ICICI Bank account or not, you can still use ICICI iMobile Pay UPI services.

Just Install the app, register with your Bank registered mobile number, link your bank account number with the app, and create your UPI ID and PIN and you are ready.

Don’t worry, we will provide you with a step-by-step tutorial in this post to guide you on how to create an IPO mandate using ICICI iMobile Pay UPI ID and accept mandate requests from the application. Read also: How to Buy Sovereign Gold Bond on ICICI Mobile Banking

Apply for IPO and Create a Mandate

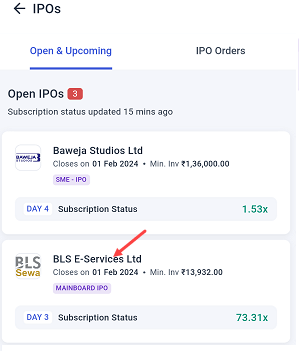

(Step 1) Open your Demat account app and go to the IPO section and select your IPO to apply.

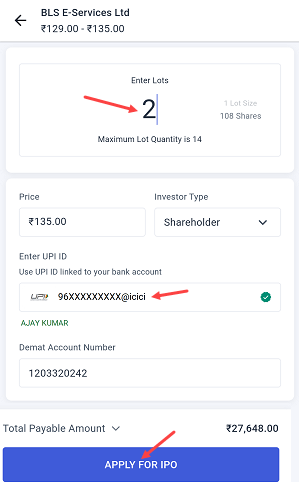

(Step 2) On the next screen, enter lots, enter your ICICI Mobile Banking UPI ID and click on Apply for IPO.

(Step 3) Your IPO application is one step away from final submission. You need to log in to iMobile Pay and approve the IPO mandate request.

Approve IPO Mandate on ICICI Mobile Banking (iMobile Pay) App

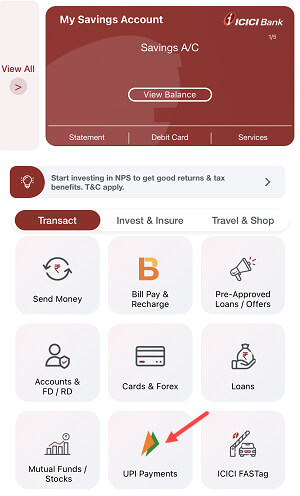

(Step 1) Login to the ICICI Mobile Banking App (iMobile Pay) and open the “UPI Payments” section as you can see in the below screenshot.

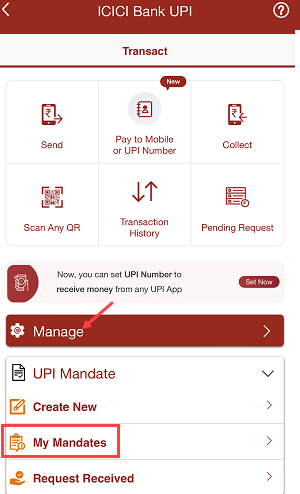

(Step 2) In the UPI Payments section, tap on the “Manage” and select the “My Mandates” option.

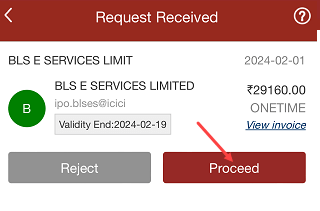

(Step 3) Tap and proceed and open your IPO mandate request.

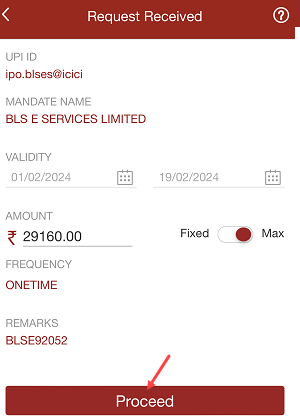

(Step 4) Next screen tap on the proceed to complete approval.

(Step 5) Tap on confirm to authorize this IPO mandate request.

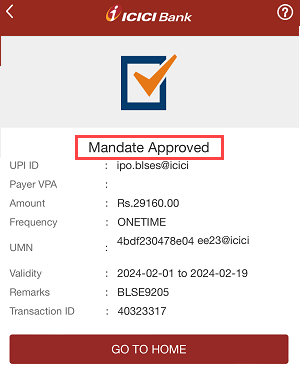

Congrats, you have successfully approved your IPO UPI mandate, you will see the “Mandate Approved” message on the next screen.

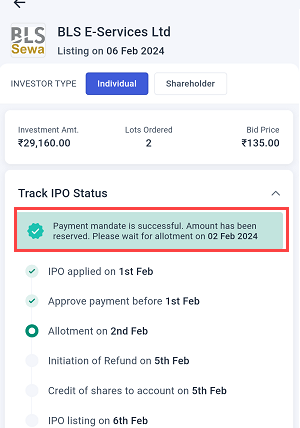

Your IPO amount will now be blocked in your bank account and your IPO application will be submitted. You can also check the status of your IPO application through the Demat account application. After 3-4 hours, you will be able to see if your payment mandate has been successful and the amount has been blocked in your bank account.

After applying for an IPO, you will have to wait for the allotment process to be completed. If you are allotted shares, the amount that was blocked in your bank account will be debited automatically. You will receive a notification when this happens. However, if you do not receive any shares, the blocked amount will be unblocked and will be reflected in your bank account within 24 hours.

So this way you can approve the IPO mandate request through the ICICI Mobile Banking (iMobile Pay) app and apply for an IPO application. Even non-ICICI Bank customers can also use the iMobile Pay UPI service.