A mutual fund SIP is a great way to invest in the stock market and build wealth over the long term. It is a simple and affordable investment strategy that allows investors to invest a fixed amount of money every month in a mutual fund scheme.

The Groww app makes it easy to invest in mutual fund SIPs. It is a user-friendly app with a wide range of mutual fund schemes to choose from. The app also offers a number of features that make it easy to track your investments and manage your SIPs.

Why invest in mutual fund SIPs?

There are many benefits to investing in mutual fund SIPs, including:

- Regular investment: SIPs allow you to invest a fixed amount of money every month, even if it’s just a small amount. This helps you to build wealth over time, even if you can’t invest a large sum of money upfront.

- Diversification: Mutual funds invest in a basket of stocks or bonds, which helps to reduce your risk. SIPs allow you to invest in a variety of mutual fund schemes, which further diversify your portfolio.

- Professional management: Mutual funds are managed by professional fund managers who have the expertise to choose the right investments for your portfolio.

Benefits of investing in mutual fund SIPs on Groww app

The Groww app offers a number of benefits for investors who want to invest in mutual fund SIPs, including:

- Wide range of mutual fund schemes: Groww offers a wide range of mutual fund schemes to choose from, including equity funds, debt funds, and hybrid funds. This gives investors the flexibility to choose the right schemes for their investment goals and risk appetite.

- Low investment amounts: Groww allows investors to start investing in SIPs with as little as ₹500 per month. This makes SIPs accessible to investors of all income levels.

- Easy investment process: The Groww app makes it easy to invest in mutual fund SIPs. Investors can simply create an account, choose the mutual fund scheme they want to invest in, and enter the SIP amount and frequency. Groww will then automatically invest the SIP amount on the chosen date.

- Flexible investment options: Groww offers a number of flexible investment options for SIPs, such as the ability to change the SIP amount, frequency, and scheme at any time.

How to invest in mutual fund SIPs on Groww app

To invest in mutual fund SIPs on the Groww app, follow these steps:

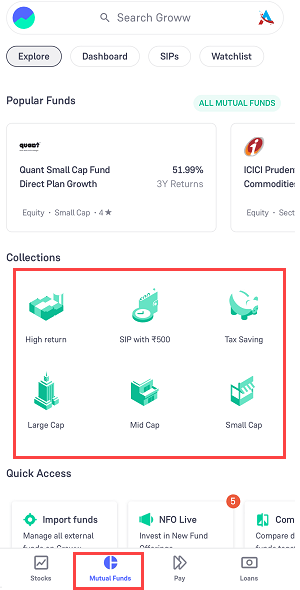

(Step 1) Open your Groww App and login to your account. Now go to the “Mutual Funds” section where you can see many fund schemes like smallcap, midcap, large-cap etc. Choose your mutual fund scheme according to your risk. For high risk-high return choose smallcap & midcap and for low risk-low reutn choose largecap funds.

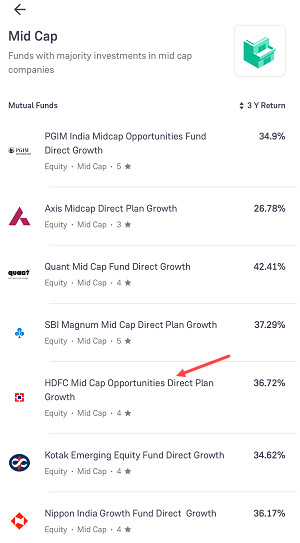

(Step 2) To get higher returns you can choose SmallCap & MidCap. So here we have selected the MidCap option and here we will select “HDFC midcap fund” to start SIP.

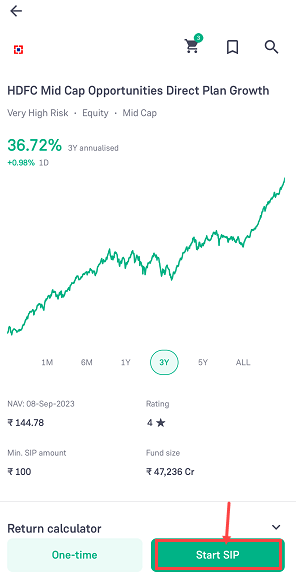

(Step 3) Once you’ve chosen a mutual fund scheme, take a look at its chart and performance. This will give you a better understanding of how the scheme has performed in the past and how it has reacted to different market conditions. Once you’re happy with your choice, tap the “Start SIP” button to start investing.

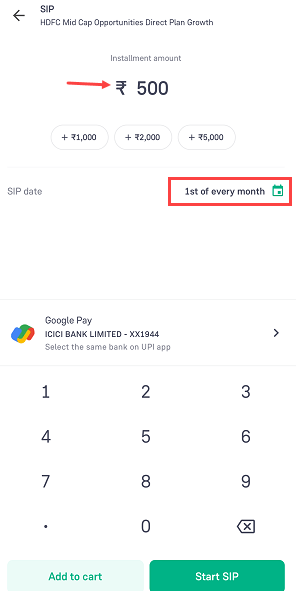

(Step 4) Next screen you can enter the SIP amount of your choice. You can start your SIP with 500, 1000, 2000 or more as you wish. After entering the amount, tap on the Date calendar to select the preferred date for SIP.

(Step 5) Choose your preferred date for SIP payment. You have to pay your SIP on this selected date every month. You can change this date anytime.

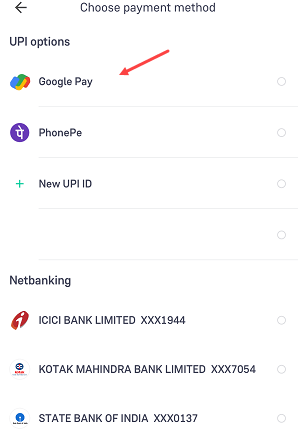

(Step 6) Now select your payment method to pay your first SIP amount. You can pay your SIP amount using any UPI application and net banking.

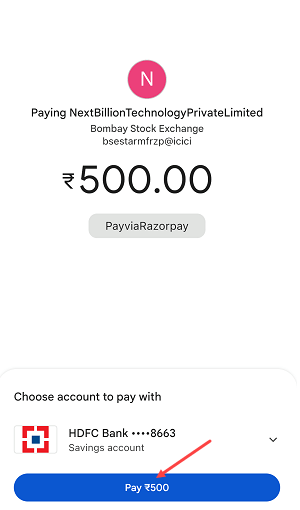

(step 7) Here we have selected Google Pay to pay the SIP amount. Now pay the first SIP amount.

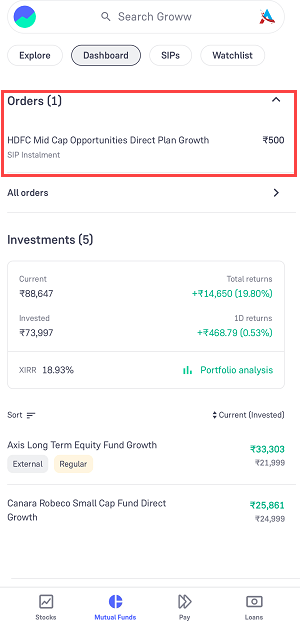

(Step 8) After successful payment, your SIP ordered will be placed. You can see your order is under process in the mutual fund section. Wait for 4-5 days, the mutual fund house will process your SIP and then you can see your SIP investment in the mutual fund dashboard.

Now pay your SIP amount every month on the selected date. You can also change the date of the SIP or skip the SIP for next month.

Tips for investing in mutual fund SIPs

Here are some tips for investing in mutual fund SIPs:

- Choose the right mutual fund scheme: Do your research and choose a mutual fund scheme that is appropriate for your investment goals and risk appetite.

- Start investing early: The earlier you start investing, the more time your money has to grow.

- Invest regularly: Invest a fixed amount of money every month, even if it’s just a small amount.

- Rebalance your portfolio regularly: As your investment goals change and the market fluctuates, it is important to rebalance your portfolio to ensure that it is still aligned with your needs.

Common mistakes to avoid

Here are some common mistakes to avoid when investing in mutual fund SIPs:

- Investing too much money too soon: Don’t invest more money than you can afford to lose.

- Investing in the wrong mutual fund scheme: Do your research and choose a mutual fund scheme that is appropriate for your investment goals and risk appetite.

- Not investing regularly: It is important to invest a fixed amount of money every month, even if it’s just a small amount.

- Not rebalancing your portfolio regularly: As your investment goals change and the market fluctuates, it is important to rebalance your portfolio to ensure that it is still aligned with your needs.