Are you looking to activate the Canara ai1 Mobile Banking app on your phone? If so, I would be happy to guide you through the process. In today’s topic, I will provide you with a step-by-step tutorial on how to register and activate Canara mobile banking with your debit card.

With Canara Mobile banking app, you can access many banking services online that can simplify your banking experience. You can transfer money to any bank account, check your account balance and transaction history, request a new cheque book, view your Debit card details and even create an ATM PIN. Additionally, you can open Fixed Deposit (FD), Kisan Vikas Patra (KVP) and Recurring Deposit (RD) accounts, view your detailed account information and much more, all at your fingertips.

How To Register & Activate Canara Mobile Banking App

If you have an active ATM/Debit card, you can activate the Canara mobile banking app on your phone to start your digital banking experience.

(Step 1) First of all download and install the Canara ai1 Mobile banking application on your phone. The application is available on the Google Play Store and iOS Store.

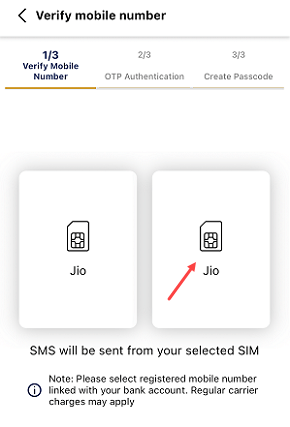

- Once you installed the Canara ai1 Mobile Banking app, now open the application and select your registered mobile number SIM for verification. When you select your SIM, an SMS will be sent from your registered mobile number and your number will be verified. (SMS charges apply)

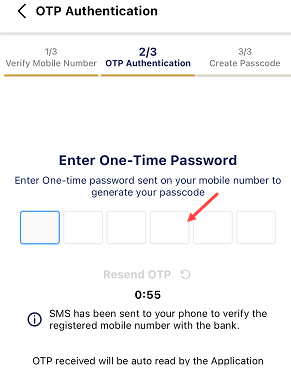

(Step 2) After verifying your registered mobile number, next screen you need to enter the OTP received on your registered mobile number.

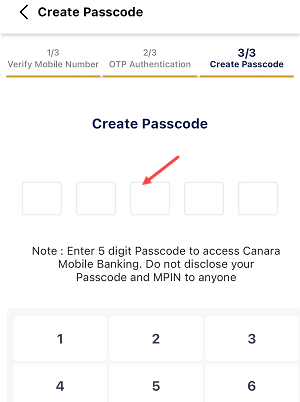

(Step 3) Now enter your login passcode. Create your 5-digit login password and submit.

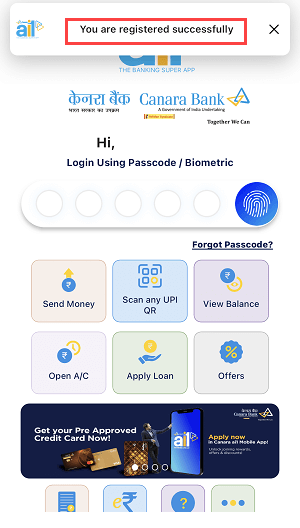

(Step 4) You are now registered with the Canara Mobile Banking app. Now you need to login with your passcode and activate your bank account using a Debit card OR activation code. Login to Mobile banking with your passcode now.

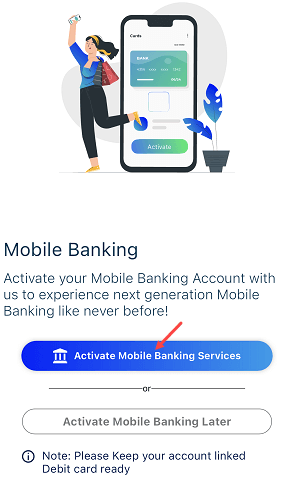

(Step 5) After login, you will be asked to activate mobile banking services. Just tap on the “Activate Mobile Banking Services” button and proceed.

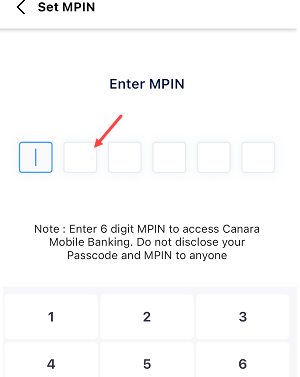

(Step 6) Now you need to create your MPIN. Enter 6-digit MPIN and submit.

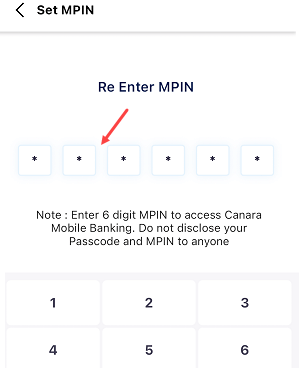

(Step 7) Again re-enter your MPIN for confirmation and submit.

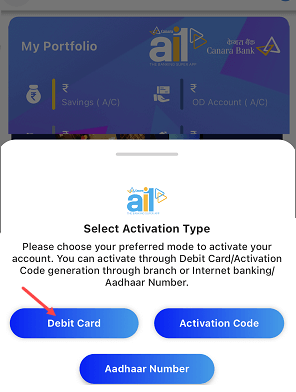

(Step 8) Now you will be asked to activate your bank account on mobile banking. You have 3 options to activate mobile banking. Choose the “Debit Card” option here.

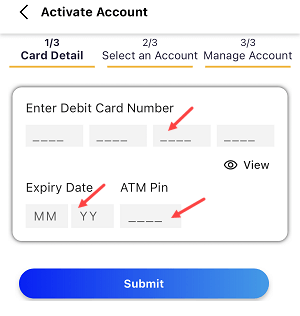

(Step 9) Next screen enter your Debit card number, expiry date (valid thru) and ATM PIN and submit these details.

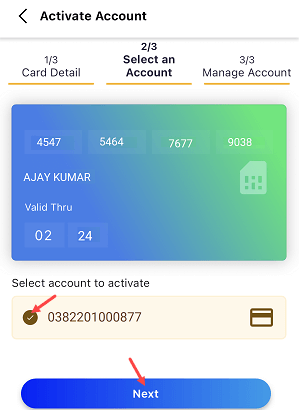

(Step 10) Once you submit your Debit card details, you can see your account number on the next screen. Select your account number to activate it on mobile banking.

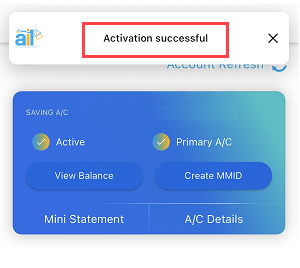

All Done! your Canara Bank account is now successfully activated on the Canara ai1 mobile banking app. Now you can access all mobile banking services from your phone.

Please note, if you want to activate Canara Mobile Banking with an Activation code then first you need to generate an Activation code online through net banking.

FAQs about Canara Mobile Banking Activation

Q.1: Can I activate mobile banking without Debit Card?

Ans: Yes, It is possible to activate Canara Mobile banking without a debit card. You can choose from two other activation options: an activation code, which you can generate online, or your Aadhaar card. If your Aadhaar card and Canara account registered mobile number are the same, then you can select the Aadhaar card option to activate mobile banking.

Q.2: Is it mandatory to have a registered mobile number in order to activate Canara mobile banking?

Ans: It is mandatory to verify your mobile number through SMS before starting the activation process. Ensure that your registered mobile number’s SIM card is inserted in your phone.

Q.3: What is MPIN & passcode?

Ans: Your 6-digit MPIN is the transaction password. You need to authenticate any transaction with your MPIN. While the passcode is your login password.